Why you should consider umbrella insurance if you have a teen driver

Personal Umbrella insurance coverage provides additional protection in addition to your current auto policy in the event of a serious accident. If you’re wondering how this can tie into adding a young driver to your insurance, here are some factors you should consider:

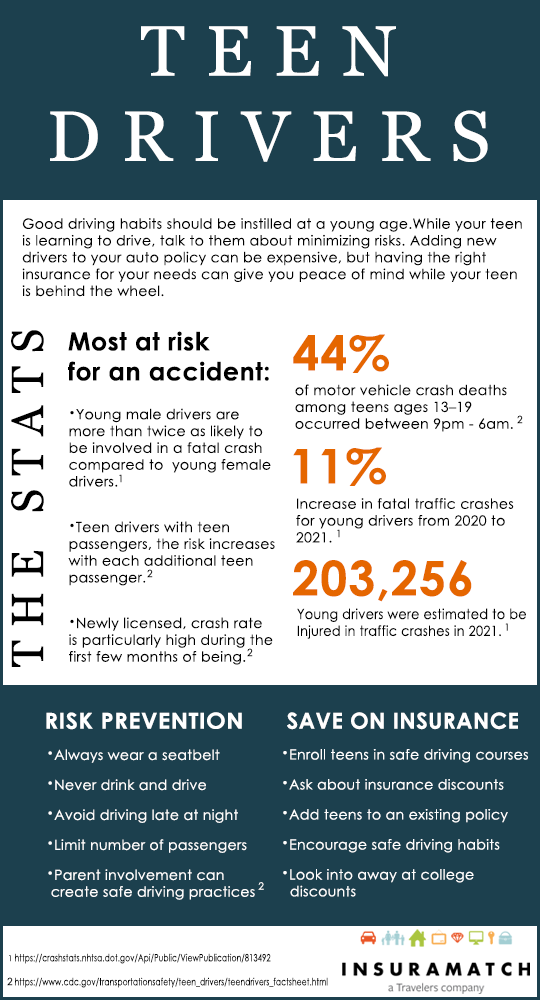

- Crash risk tends to be higher during the first months of being licensed.[1]

- Teens are at more risk due to inexperience, nighttime and weekend driving, not wearing seat belts, distracted driving, and speeding.[2]

- If you have a home or auto insurance policy, you can consider getting personal umbrella insurance.

- Umbrella coverage provides more protection than what your auto insurance can cover.

The Stats

What is covered under an umbrella policy?

The purpose of umbrella insurance is to provide additional coverage beyond your other insurance policy's liability limits. Members of your household, such as teenage drivers, are generally covered by an umbrella policy. While getting a personal umbrella insurance policy can cover a lot of situations they do typically have some exclusions; you can read more about what’s excluded from an umbrella insurance policy here.

Instead of increasing your coverage limits to your auto policy, getting an umbrella policy may be the best way to gain more protection for less money.

Ready to get a quote? Get a quote for umbrella coverage now.

Looking for more resources on umbrella insurance? Check out our blogs:

8 common liability claims that require umbrella coverage

An umbrella policy protects your assets

When do you need an umbrella policy?